If you’re just joining us for this series, please read our first installment of the series, The Prime Day Paradox: An Introduction.

Q4 is here! This is arguably the most important time of the year for many brands. We expect a higher volume of sales and deeper levels of engagement as consumers historically increase purchasing. For many of us, the assumption that this year’s Q4 will be as effective as previous years is undermined by the existing economic climate and uncertainty around purchasing habits.

However, we continue to press forward to adapt and navigate these concerns. As an agency driven by data and looking to drive unique strategies leading into Q4, we consider the upcoming retailer sales events as an optimal opportunity to get in front of consumers.

In this article, we are going to explore the benefits of Prime Day that brands need to consider for their unique situation. Why do retailer sales events like Prime Day add value? What should you be looking for from your engagement? Let’s see what Amazon has to say as they encourage increased brand investment into Prime Day.

How does Amazon “sell” Prime Day participation to brands?

BBE has participated in Prime Day since the event’s inception in 2015. We often see Amazon shaping the narrative around three key factors for brand participation in Prime Day using an increasing level of detail and analysis. The question we must ask ourselves is, “If Amazon touts these factors as benefits of participating in Prime Day, did we actually receive them to the degree that we expected?” Let’s unpackage these benefits one at a time.

Audience Reach

Prime Day is widely seen as a high-traffic-driving event, and brands are encouraged to offer deals and leverage advertising tools to drive substantial traffic to their products before, during, and after the Prime Day event. As a reference, in their 2021 Prime Day Review, Amazon shared that in the two-week lead-up to Prime Day, customers spent $1.9 billion on small-business products, showing that traffic and sales are not solely regulated to the two-day event itself. When we consider this benefit, there is much to assess related to traffic around Prime Day.

What should you be looking for?

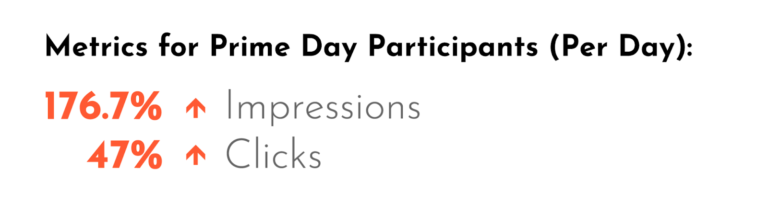

For brand partners here at BBE, we saw a lift in key advertising metrics which correspond with what we wanted to see from Prime Day:

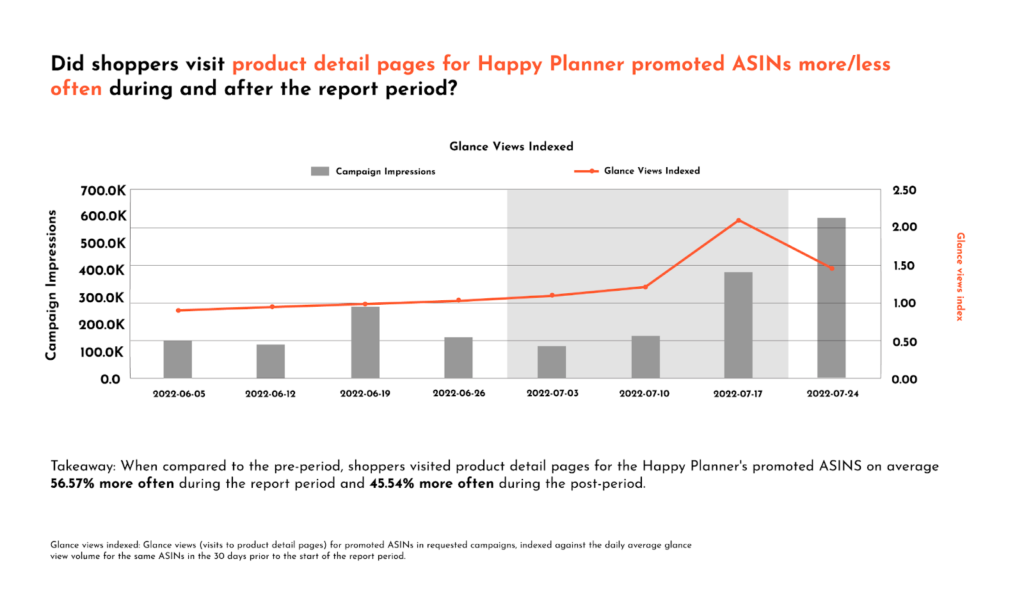

For specifics, we look at the Views and Sessions that we received on our Detail Pages as an assessment and validation of our engagement in Prime Day.

We assessed this data for Happy Planner, a brand with a mission to spread happy wherever they go and inspire daily organization. We saw that shoppers visited the product detail pages of our promoted ASINs 56.57% more often during the report measurement period, and this uplift stayed at 45.54% the week following the event.

The data in the chart above helps us understand the extent of the audience that we reached. If you’re not getting a similar analysis from your existing agency or from Amazon, BBE can help you understand where and how you procure it in the future.

Increased traffic and views on our products help tell part of the story, but what many of us care about is bringing in incremental purchasers to our product, which leads us to the second key factor of Prime Day.

Attract New Shoppers

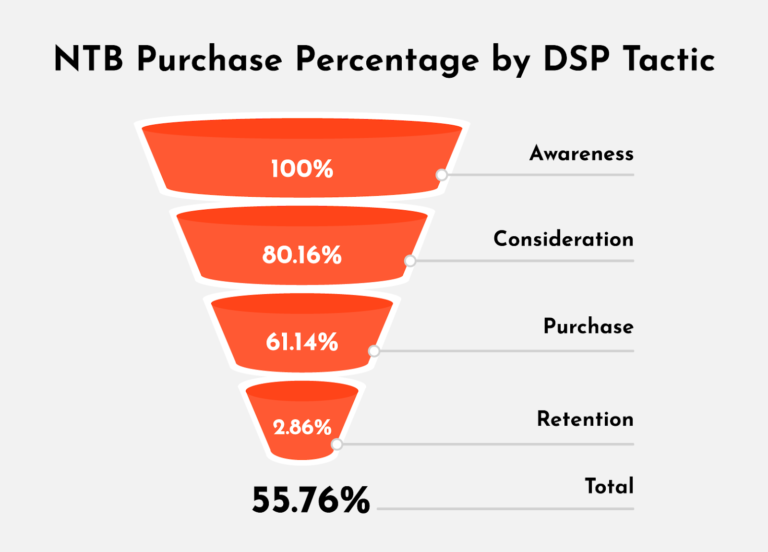

Amazon shares that sales events, like Prime Day and Black Friday, are key for attracting a high number of new-to-brand (NTB) shoppers. According to their study on coffee customers, Prime Day attracts 2.1x more NTB purchasers than on an average day. These numbers are improved when you combine discounting with DSP advertising. As brands consider how they leveraged the increased traffic of Prime Day to convert shoppers, they should be leveraging Amazon Audience Insights to gauge NTB shoppers across their catalog.

Brands like Readywise, a company that brings peace of mind to consumers by offering ready-made food for preparedness and outdoor use, brought in a number of NTB shoppers over Prime Day.

In addition to a 35% overall increase in Prime Day Sales YoY, we saw that the discounts run over the sales event combined with DSP full-funnel strategy achieved an overall NTB conversion of 55.76% over the month of July.

BBE sees developing a holistic full-funnel advertising strategy as a critical part of taking full advantage of retailer sales events. In order to be most successful, brands must engage in running ad campaigns well before the event so they can be optimized for higher effectiveness on core KPIs leading into these tentpole events. As we add more shoppers to our brands, we dive deeper into the most sought-after factor from participation in retailer sales events.

Increase Sales

Not surprisingly, Amazon positions Prime Day as a premier sales event throughout the year. Prime Day is perceived to be a relatively high sales driver, and Amazon supports this by offering ever-increasing Prime Day sales volume year over year, despite the increased time measurement of each subsequent year. While many of us likely saw sales deals with great run rates, the value of the overall sales volume depends on the types of products that you are selling, the frequency at which shoppers engage, and the secondary effects your discount may have on your shopper base.

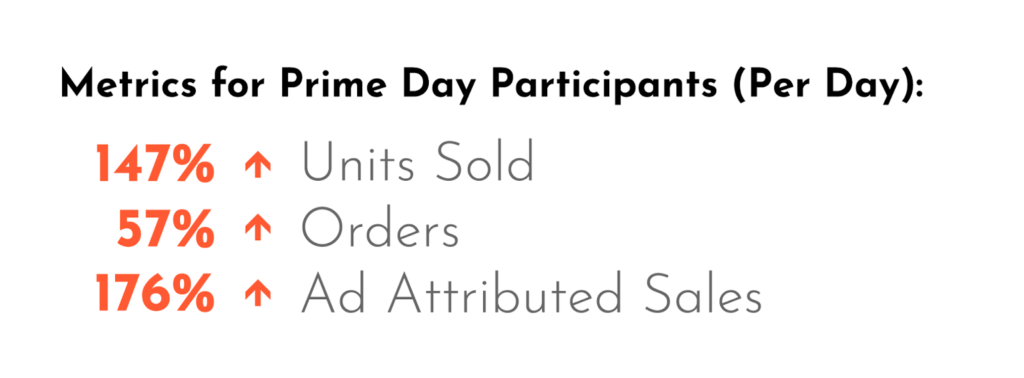

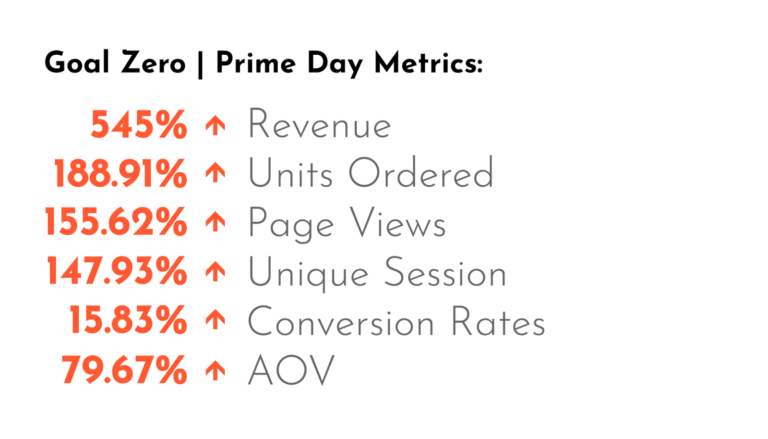

Looking across our portfolio of brands that participated in Prime Day, we saw, on average, an uplift in the following metrics due to the advertising we ran over the event.

Goal Zero, known for providing energy solutions globally to power anything, anywhere, exceeded many of the baseline metrics across Prime Day. As a proponent of brands’ participation in Prime Day, they engaged in offering discounts across much of their catalog. They leveraged a comprehensive advertising strategy that launched campaigns in the weeks leading up to Prime Day and kept them live until two weeks after the event. The goal was to drive traffic to their detail pages, increase conversion, and increase AOV, all of which exceeded expectations.

We asked Goal Zero for additional insights on what drove their success over Prime Day.

“With the increased traffic on Prime Day, the lead-up strategy is very important as we promoted the Prime Day discounts via email blast and off-Amazon channels, such as Social Media and PR articles. Deeper discounts always provide better results, and the inclusion of many products, including the top sellers, is critical to Prime Day success. You need to discount the products shoppers want and not just the products that we want to sell.

We would definitely recommend participation in Prime Day. Competitors all participate with deep discounts. New-to-brand shoppers become loyal customers to the brand as we offer many related and compatible products in the Goal Zero ecosystem.”Felipe Soares, Digital Marketing Manager at Goal Zero

Prime Day can be a very effective tool to deepen your reach, convert new shoppers, and drive more sales. Brands can find value in retailer sales events when they leverage all tools at their disposal to increase these effects. Not all brands are created equal, and not all brands are as successful in their results. In our next article, we will look at the other side of this paradox to better understand why many brands are choosing not to participate in Prime Day.