Amazon started as an ecommerce business selling books in 1994. Fast forward 23 years and Amazon has many billion dollar businesses generating revenue. Whether it is third party marketplaces sales, Amazon’s own retail sales, Fulfillment by Amazon (FBA), or more recently, Amazon Web Services (AWS); each business unit generates significant revenue to drive Amazon’s success. More recently, Amazon’s advertising business has come front and center in the public eye due to its size, growth, and attention from large agencies and advertisers.

Birth Announcement: Amazon Advertising

In 2008 Amazon hired Liza Utzschneider from Microsoft to build out their advertising business. The idea was simple – marry ecommerce and advertising. Leverage all of the digital assets that Amazon owns to provide brands and third party sellers with an opportunity that leads to a transaction.

“The first is display advertising across our owned and operated sites including Amazon.com, IMDb.com, DP Review, and Diapers.com(now defunct ). The second is advertising on connected devices, including Kindle E-readers, Kindle Fire tablets and mobile, both IMDb’s mobile apps and the Amazon shopping app. The third is connecting with Amazon customers on the internet. And the fourth area, which I’m very excited about, is video.” – Liza Utzschneider

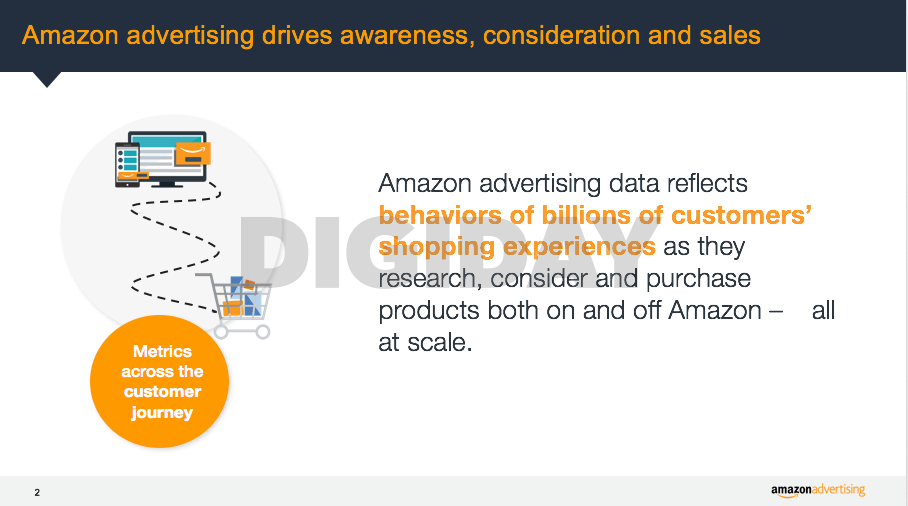

Amazon wants to keep customers on the various platforms that they own to ensure that browsing leads to conversions/sales of products. Wired said it best in 2012, Facebook knows who your friends are. Google knows what you’re interested in finding on the internet. Amazon knows what you’ve bought, and has a pretty good idea of what you might want to buy next.

Amazon is, in its purest form, a data based business, able to leverage anonymized customer data to provide customers with peace of mind regarding their transactions and browsing history. In an interview with Ad Age, Utzschneider described Amazon’s ad business not so much as a money maker but as a subsidy that would let the company push its retail prices lower:

“If we think about Amazon in two worlds, one world is an Amazon with ads and lower prices. Another world is an Amazon with no ads and higher prices. Which one would we choose?”

Advertising – ‘The Amazon Way’

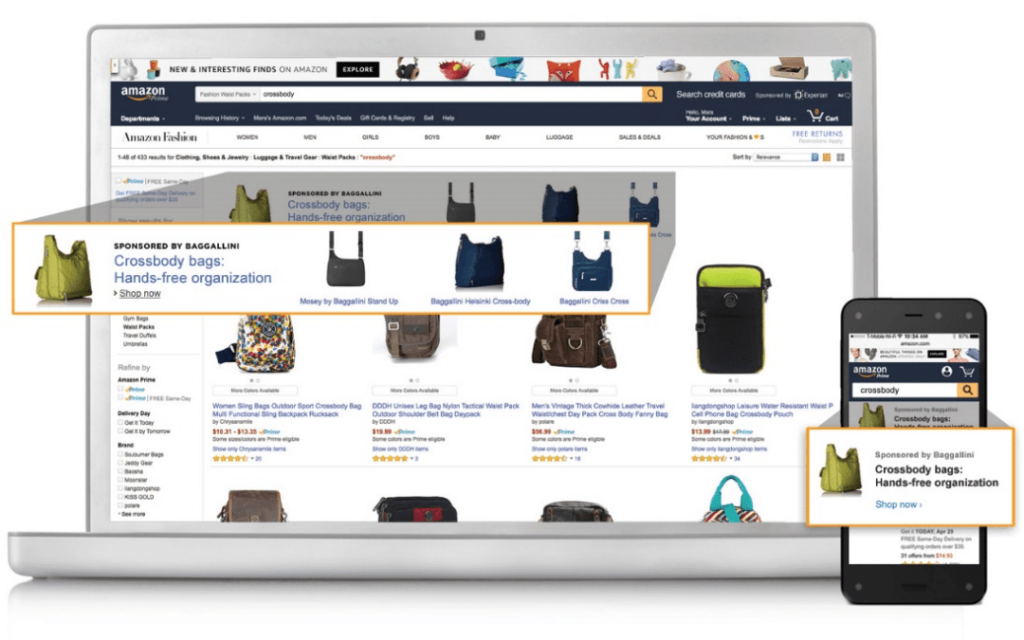

According to Bloomberg Businessweek, Amazon focused on highlighted search results and banner ads, initially. The company is now emphasizing a collection of options such as coupons, embedded buttons that add items to wish lists, offers of standing monthly orders, space on its shipping boxes, and a network that delivers ads to other websites. Some of those services are even available to brands that don’t sell on Amazon.

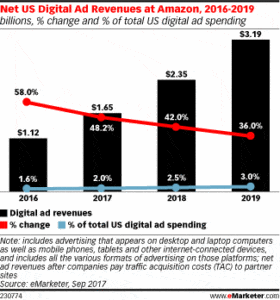

The long term impact on Facebook and Google’s advertising revenue must not be underestimated as Amazon is able to provide brands and sellers with access to 300 million customers who have Amazon accounts. Business Insider projects that Amazon’s ad business could reach $5b in size by 2018. Yes, it is no immediate threat to Google’s gigantic advertising business (40% of all US digital ad revenues in 2017), but in a space of 3 years, Amazon has been able to generate revenue of about ~$1.65b from their advertising business.

Source: Emarketer

According to Digiday, Amazon is ramping up its advertising pitch to agencies and brands. The company recently expanded its self-serve programmatic advertising offering so agencies can now buy ads on their own through Amazon Media Group (AMG). It also extended some of the AMG offerings to third-party sellers on the platform, going as far as to offer them discounts and incentives to advertise on the platform.

“They take customer obsession seriously,” according to Kristin Lemkau, chief marketing officer at JPMorgan Chase. “And I think they feel like the first big, emerging advertiser that can be grouped with Facebook and Google.” Now that is an endorsement from an unlikely source.

Amazon’s end to end ownership of its transactions and direct consumer interactions means it can offer CPGs closed-loop targeting and attribution without margin-eating intermediaries or the same privacy burdens. CPG companies are looking to ecommerce for a sustainable future. Currently, most are retail focused, facing challenges like mall closures or store closures.

Brands – You need an Amazon advertising strategy

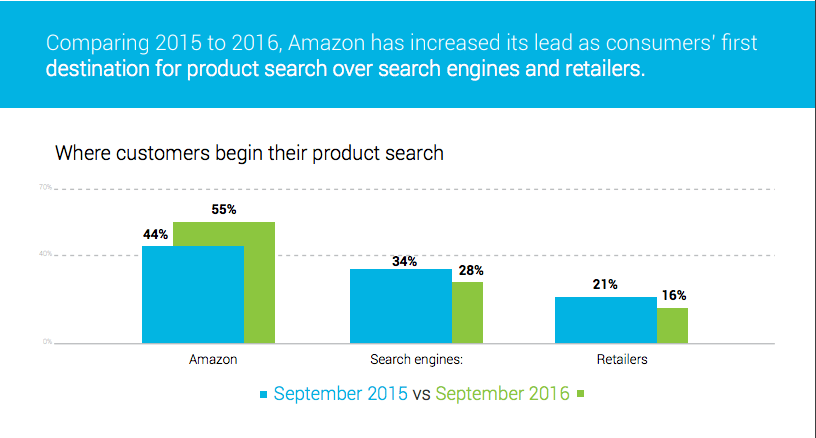

Over the last three years, Amazon has grown their percentage of total customers starting their product searches online. A metric like this bodes well for the burgeoning ads business. In 2016, 55% of customers surveyed by Bloomreach started their product searches on Amazon instead of Google. That figure grew 25% from 44% in 2015 and highlights the growing strength that Amazon has developed as a reliable first-stop product search engine.

The simple truth is that brands are now having to recognize that Amazon is not just a place for selling products but also a channel in which marketing capital has to be spent in order to access customers who purchase products.

As Amazon’s dominance in product search has grown, failure to have one’s products or advertising on Amazon, in-effect, ensures that your brand is not discoverable to customers. Brands need to have the approach that, even if they are not listing their products on Amazon, their products will show up on Amazon, whether by gray market inventory finding its way to Amazon’s Retail business or by your own distributors’ third party stores on Amazon.

Brands need to ensure that once a customer finds them on Amazon via product search, that the information contained in the listings are accurate and complete. Spending advertising money to showcase products that are not optimized properly will yield inefficient ad spend and poor results.

Because Amazon holds leading positions in Google’s search results, having accurate data to properly portray your brand is even more important. Amazon has strong positioning in Search Englne Optimization, and your brand’s presence on Amazon can share this value if managed properly.

If I were a brand manager or account manager looking after a collection of brands, I would be looking at advertising on Amazon. The power of Amazon’s first party customer data gives confidence to the marketer seeking a positive ROI, knowing that the systems and data in Amazon’s advertising programs are data-driven and conversion-oriented.

If you’re one of the estimated 20%–40% of brands who fire their agency annually, you can’t focus on that vision if you have to keep searching for the right support. BBE proudly retained >95% of our clients last year while applying focused dedication to our brand partners. If you’re ready to start over for the last time, contact us and find out why leading brands have partnered with us for so long.