When one thinks about Amazon, it’s usually as a market leader, built on the company’s resonant founding principle: delight customers. However, in Japan and China, this is not the case. In these two markets, they are simply another competitor trying to oust local market leaders.

(Photo By Nick Youngson/CC BY-SA 3.0 NY)

Amazon has seen its competitors in the two countries control market share and dominate their respective markets, making it much more difficult for Amazon to grow their businesses in these foreign markets. (One could likely read the inverse of this piece from Alibaba’s or Rakuten’s perspective on competing in the US market, but that’s for another day…)

Amazon’s Japanese entrance

Amazon entered Japan in 2000 by leveraging market share built on Japanese customers buying foreign books at high import costs from Amazon.com. Japan is the second largest book market in the world, and as Amazon’s roots are in books, one could understand why Amazon believed they could enter Japan with the same methods they used to developing their dominance in the US and other international markets.

So, as Amazon’s fourth international market, the company followed its pattern of employing non-Japanese leadership—but this created a bit of a problem. The lack of local leadership set Amazon’s efforts back, as local executives would have understood the nuances of the local market with their native experience, while the international executives Amazon went with could only rely on theory and their US ecommerce background.

Interestingly, Japan was also the home of Amazon.com’s millionth customer, who received a personal delivery of books from Amazon.com’s founder and CEO, Jeff Bezos, in Tokyo in 1997.

In launching its Unicode-enabled platform for its Japanese language site in 2000, Amazon experienced the difficulty of translating its mission to local customers. While Amazon Japan has presented one cheery message via press releases and messaging, the company has struggled in the country.

Amazon initially tried to recreate their US operations in Japan, but didn’t take into consideration how to onboard local merchants in a way suitable to those merchants’ expectations—something their biggest competitor and Japanese market leader Rakuten has excelled at from day one, a key part of their dominance over Amazon. Rakuten has dominated due to their local leadership and the guidance of founder Hiroshi Mikitani, who has grown the business to a dominant position while leveraging other services to grow Rakuten’s impact in the country.

The company’s bio (from its website) sounds a lot like a description of Amazon in the US today:

When Hiroshi “Mickey” Mikitani started Rakuten Ichiba in 1997, no one believed that people would shop online. But Mickey and his five colleagues believed differently. We have since grown to offer services across finance, sports and entertainment and more. We’ve partnered with businesses around the world that share the same values as us. Now, we’re bringing these diverse elements together in one ecosystem, united under the Rakuten umbrella.

The Chinese lesson

Several years after entering the Japanese market, Amazon made its play for China.

Amazon acquired Chinese web retailer Joyo in 2004, acknowledging the “unique challenges” of entering the country’s ecommerce market—but without truly understanding the nuances of Chinese ecommerce. Chinese ecommerce is unlike any Western ecommerce market, and it takes different strategies to win there. Joyo, unfortunately, was plagued by counterfeit products and leadership that did not assist Amazon in recommending changes to grow market share in China.

According to CNET, Amazon went into China with the mission of using “the same template for running the Chinese operation that it has applied in other regions, making sure that it respects local customs and regulations regarding the products it sells in the region.”

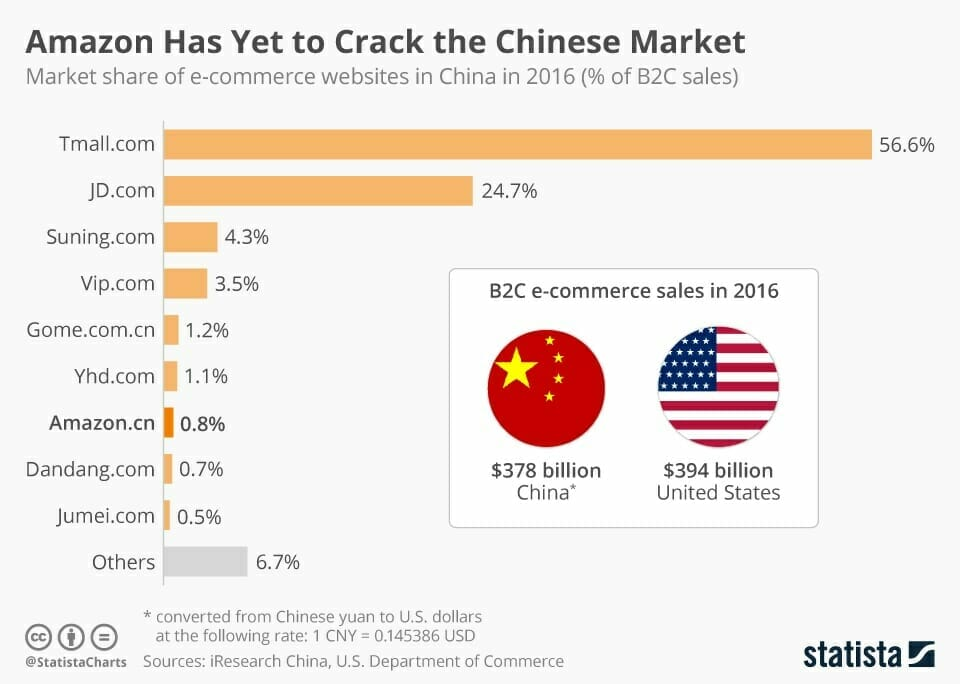

But this template was not enough to make a dent in the ecommerce market leader standings, as we’ll see in a moment.

The Big Picture

Amazon entered the Japanese and Chinese markets for a simple reason: these markets are growing fast and will have significant impact on the ecommerce industry as a whole. But it will be an uphill climb for Amazon, to say the least. In Japan, Rakuten has 2.5 times as many users as Amazon—not an insurmountable lead, but while Amazon is slowly gaining momentum, they are still far away from toppling the market leader. China, meanwhile, is the fastest-growing ecommerce market, but leader Alibaba has an apparently unassailable 50x larger share of the market than Amazon at present.

Amazon looks for cracks in the armor in China and Japan

Amazon is using cross-border ecommerce to attempt to conquer both China and Japan, banking on Chinese customers’ love of purchasing products from Japan. In China, Amazon has done the unthinkable and even created a store on Alibaba’s Tmall to reach customers on that platform.

In November 2014, Amazon launched a storefront on its Chinese site that allows Chinese Prime members to shop millions of international products from the Amazon Global Store. Prime in China is not about speed like in the US, but rather selection.

And in June 2017, Amazon launched a customized Kindle for Chinese customers. In addition to holding titles from Amazon, it also lets users shop at Migu, a popular e-book store run by state-owned China Mobile. Like Amazon, Migu offers over 400,000 titles. Amazon’s decision to partner with China Mobile is a sign that Amazon is willing to work with Chinese partners and with the Chinese government to gain a foothold in the country.

In Japan, Amazon is looking to use speed and partnerships with local retailers to delight customers. The company has been working to fulfill local deliveries to customers via same-day delivery, but this effort has placed strains on local logistics partners, who have faltered in meeting Amazon’s and customers’ high expectations.

It’s becoming clear that for Amazon to continue to grow they will need to grow their international business, but so far Amazon’s international properties have not succeeded to the same degree their US business has. International business provides Amazon with access to new customers in markets they enter via either an acquisition (China and the Middle East) or a new business (Japan and more recently, India). But it also presents Amazon with new problems. I believe that Chinese ecommerce is all but lost for Amazon, and thus focusing on Japan, Europe, and other new markets is where the company is more likely to reap dividends.

If you’re one of the estimated 20%–40% of brands who fire their agency annually, you can’t focus on that vision if you have to keep searching for the right support. BBE proudly retained >95% of our clients last year while applying focused dedication to our brand partners. If you’re ready to start over for the last time, contact us and find out why leading brands have partnered with us for so long.