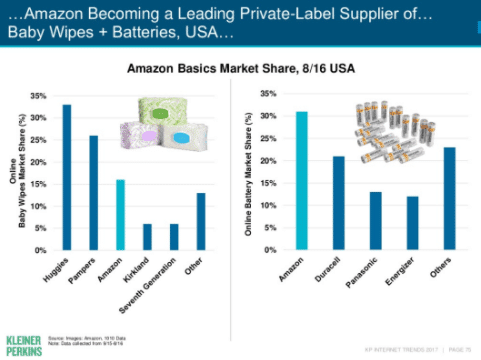

Amazon has more customer search and purchase data than any e-commerce business. It is able to spin up private label brands in six months flat based on data and customer intent. Knowing what customers are looking for and what is popular in terms of sales gives Amazon a large advantage against brands looking to boost sales.

Their private label brands have access to the best merchandising and best targeting available on the marketplace. And the brand doesn’t even need to be profitable or drive significant revenue. These brands only need to operate as trojan horses generating sales from customers and providing Prime customers with products that are exclusively available to them. How do national brands compete with this?

Amazon leverages data on what Prime customers buy and starts brands based on the purchase intent of their most profitable customers. As Amazon’s third party marketplace has grown to almost 50% of all products sold to customers on Amazon.com, they are using the data collected from customers to enter categories for which they are either not the seller of the top products (fashion) or for which they provide cost-effective alternatives to everyday items (batteries, iPhone cables etc).

cables etc).

According to Business Insider:

The e-commerce giant offers everything from burgers to beauty products under its collection of 34 private-label brands. Combined, sales of those products could add $1 billion to its gross profit by 2019, Morgan Stanley analyst Brian Nowak said in a research note issued Tuesday.

Amazon becomes the elephant in the room for brands

Amazon is using ‘secret’ brands to impact categories in which customers have a high rate of recurring purchases. Ultimately they use their large data advantage to develop products that are cheaper than those that are sold by recognized brands.

Third party sellers thought for a while that creating their own private label products would counter the impact that Amazon would have on their businesses. By creating their own private label products, Amazon essentially competes against their top selling third party sellers and ensures that they can generate more money to invest into their marketplace business.

According to Inc, Amazon has quietly launched around 20 private label brands — custom brands that you can’t buy anywhere else — covering fashion, women’s fashion, baby clothing, and snacks. According to an analyst note from SunTrust Robinson Humphrey, those brands racked up around $2.5 billion (£1.9 billion) in sales for Amazon in 2016 alone.

Amazon does not care who it competes against

Private labels provide Amazon with an opportunity to create revenue by leveraging data that they already own. Third party brand owners inherently create the products that become popular. Amazon realizes they can become the seller of a similar looking product at better margins, and then becomes category leader based on reviews and popularity. Brand name products face pricing challenges when listing on Amazon while private label manufacturers face the reality that, at any time, Amazon could enter their category and syphon off sales based on data and lower prices.

Private labeling is not a strategy for competing with Amazon as Amazon ultimately is both a mercenary and missionary for these brands. Mercenary in the sense that they are in constant doubt about Amazon’s impact and category entrance, and Missionary in that they provide customers with similar products at lower prices.

The private label end game

Besides generating additional revenue, the real reason for these private labels is to provide Amazon with an advantage over branded products. The advantage is that Alexa picks Amazon private label products over branded products when customers voice-search for products. (A trend that some say will reach majority share of search-types by 2019) That provides Amazon with a revenue stream that cannot be touched by rivals or brands.

Amazon also uses supply and demand by making some of these private label brands only accessible to Prime customers. Thus customers who want to purchase these products require a Prime membership, which is yet another avenue for Prime membership growth.

Early revenue indicators

Amazon is gaining share from category leaders and growing this business at speed. According to Business Insider, private labels have generated $2.5 billion in 2016. Amazon is expected to generate roughly $4.3 billion in 2017 sales from its growing army of private label products, according to SunTrust Robinson Humphrey’s Youssef Squali.

Brands need to be aware

As long as Amazon refines its skills in building private label brands quickly, national brands will need to play catch up very quickly starting with:

- Being prepared to launch new brands in under the usual 2-3 years cycle that is currently seen with national brands.

- Considering the launch of private label brands that are generating annual revenue only $20mm-50mm, not the usual $500mm – $1B threshold used by national brands currently. This is yet another mindshift that brands will need to make to counter Amazon’s current private label momentum.

- Ensuring all of their existing brands’ product listings are properly optimized, and supported with appropriate levels of advertising spend on Amazon.

Bonus: How many private labels does Amazon own?

The definitive answer is – only Amazon really knows the answer to that question. The following is a collection of brands that have been identified as being owned by Amazon. Some of the products has “An Amazon brand” in their descriptions and others not.

| Brand | Product |

| Arabella | Lingerie |

| Beauty Bar | Cosmetics |

| Denali | Tools |

| Franklin & Freeman | Men’s shoes |

| Happy Belly | Fresh food |

| James & Erin | Women’s clothing |

| Lark & Ro | Women’s clothing |

| Mae | Underwear |

| Mama Bear | Baby products |

| Myhabit | Consumer goods |

| North Eleven | Women’s clothing |

| NuPro | Tech accessories |

| Pike Street | Linen |

| Pinzon (by Amazon) | Linen |

| Scout + Ro | Kid’s clothing |

| Single Cow Burger | Frozen food |

| Small Parts | Spare parts |

| Smart is Beautiful. | Clothing |

| Strathwood | Furniture |

| Presto! | Household essentials |

| Wickedly Prime | Food |

| Amazon Elements | Vitamins * |

| Amazon Basics | Generic private label |

| The Fix | Shoes & handbags |

| Society New York | Women’s dresses |

| Paris Sunday | Women’s clothing |

| North Eleven | Women’s winter wear |

| James & Erin | Cardigans |

| Iris Lilly | Lingerie |

| Goodthreads | Men’s clothing * |

| Franklin Tailored | Men’s clothing |

| Find | Basics |

| Ella Moon | Women’s wear * |

| Coastal Blue | Women’s swimwear * |

| Buttoned Down | Men’s shirts * |

| Smitten | Women’s clothing |

| Rebel Canyon | Men’s & Women’s active wear |

| Goodsport | Activewear |

| Peak Velocity | Activewear * |

| Core 10 | Women’s Activewear |

| Trailside Supply Co. | Men’s Outerwear * |

| Crafted Collar | Men’s Shirts |

| Daily Ritual | Women’s Clothing * |

| 206 Collective | Men’s and Women’s Shoes * |

| Peace Love Maxi | Women’s Clothing |

| Paris Sunday | Women’s Clothing * |

| Velvet Rope | Women’s Clothing |

| Essentialist | Women’s Clothing |

| HALE | Denim Jeans |

| Emma Riley | Children’s Clothing |

| Rivet | Furniture and Lighting |

| Stone & Beam | Household Furniture |

* Indicates Prime membership required for access

Sources: Loose Threads, Quartz, L2Inc

If you’re one of the estimated 20%–40% of brands who fire their agency annually, you can’t focus on that vision if you have to keep searching for the right support. BBE proudly retained >95% of our clients last year while applying focused dedication to our brand partners. If you’re ready to start over for the last time, contact us and find out why leading brands have partnered with us for so long.