Crash Course in Accounting

If you’re going to be in business, you must know how to keep score.

To gain this knowledge will require that you go to school to learn both accounting and computer software that is used to support your particular business.

Do’s and Don’ts

Top Ten Do’s

- Learn basic accounting before you go into business. Go to school if necessary.

- Consult and retain an accountant familiar with your industry before you start.

- Determine what accounting software program works best for your business.

- In the beginning, do your own bookkeeping to gain knowledge of your accounting.

- Set up inventory policies and internal controls including safeguards against dishonesty.

- Reconcile your bank account at least once a month when your bank statement is received.

- Maintain and update your cash flow spreadsheet monthly.

- Plan to outsource your payroll and payroll reporting to a payroll service provider.

- Look at your financial statements at least monthly.

- Keep your business records separate from your personal records.

Top Ten Don’ts

- Delegate the authority to sign checks to anyone.

- Use money withheld for payroll taxes or sales taxes for other purposes.

- Comingle personal assets with your business assets.

- Delegate cash flow projections–your lifeline to liquidity.

- Be optimistic in sales projections or conservative in expense projections.

- Rely on verbal agreements on any important matter including purchases.

- Pay an invoice without matching it to your purchase order.

- Delegate your relationship with your lending sources.

- Wait to establish credit sources until you have a need for financing.

- Overlook seeking advice from your accountant and lawyer on important financial matters.

The financial matters you will confront in your own business are little different than those of large corporations. Financial tools, coupled with an understanding of how to use them, will assist you in the proper management of your business.

Without this understanding and without a dedicated commitment to using the appropriate financial tools, you will reduce your chances of success.

Let’s start off by addressing the common misconception that Accounting is simply “the recording of financial transactions for various reports and analyses.”

What’s the Reality? Well, when day to day transactions are recorded, this is called basic book keeping. Part of accounting includes book keeping, but “accounting” for our purposes, is a way of assessing the financial health of a business or an organization.

And it also is a way of presenting information in various reports and analyses for strategic decisions and compliance with business rules, regulations, and taxes.

Three Types of Accounting

Business owners should thoroughly understand the three main types of accounting. These include:

- Financial AccountingPresenting information in the form of general-purpose financial statements (like a balance sheet or an income statement)

- Managerial AccountingProviding the type of information a company needs to keep the business financially healthy. Some of the information will originate from the recorded transactions but some of the information will be estimates and projections based on various assumptions.

- Tax AccountingIt’s assumed that your CPA will prepare your business taxes, but there are also government regulations that you must comply with. There are serious consequences for failing to report and pay income, sales, and payroll tax.

What’s The Point In Explaining This?

Don’t assume your books are the best place for managerial accounting.

We have yet to find an organization that possesses an all-in-one transaction database which also provides every relevant report for management decisions.

For inventory management, sales reporting, and SKU-level profit analyses, most sellers utilize reports from a variety of sources, including:

- Channel management software

- 3rd party marketplace tools

- Directly from the marketplace channels

Most sellers have found these reporting tools more useful for business decisions than their bookkeeping system, whether that is Excel, Peachtree, Quickbooks, or MS Dynamics.

Make sure you know what taxes you need to collect and pay, and make sure that you have a system in place to collect them and to pay them.

If you don’t understand what a Profit and Loss statement is or if you don’t know what these accounting terms mean then we have a problem.

Financial Statements

Your business will be judged by the classic financial measures: the balance sheet, the profit and loss statement, and the cash flow statement.

These three measurements will define the financial health of your company. In this session you will learn how:

- The balance sheet tells how much the business is worth.

- The profit and loss statement tells if your business is profitable or not.

- The cash flow statement predicts your cash balances into the future.

Accounting Education

As a business owner, you need to feel comfortable with the values portrayed by each measurement.

Understanding these three measurements will whet your appetite to learn more, which in turn will lead to your strategic use of credit and ability to make choices tying operational activities to the best use of funds. They will help you make better decisions.

You will also need to gain knowledge of accounting in order to evaluate your competitors or businesses you might wish to acquire (or be acquired by).

While information about companies may be obtained from stock brokers or interviews with key executives, the best source to learn about your most successful and publicly owned competitors is to read their annual reports. You will need to understand accounting to draw intelligent conclusions.

Accounting courses at your local community college will give you most of what you need to know.

Talk To The Professionals

You should consult an accountant before you start. This could be a Certified Public Accountant (CPA) who is a sole practitioner or a large accounting firm that can offer expertise in many areas (and whose fees tend to be higher). Another type of accountant is an “Enrolled Agent” (EA). EAs must pass a taxation test administered by the Internal Revenue Service.

At present, there are no national certification standards for bookkeepers like there are for CPAs or EAs. So, it may be best to look for referrals when selecting a bookkeeper. Many CPAs and EAs will refer you to people they have confidence in to help you with your accounting needs.

Bookkeepers range from those who only pay bills or process receipts to “full charge” bookkeepers who can summarize bookkeeping activity for your CPA or EA to prepare tax returns.

On the other hand, if you want someone to advise you on business organization and prepare income and payroll tax returns, you will probably want a CPA or EA to help you. The more “routine” bookkeeping you know and do yourself, the better it is, because you can then afford a higher level of expertise.

Accounting Software

You will need to determine what accounting software program will work best for your business and your accountant can help decide this. Some good ways to determine this:

Ask others in your industry whose judgments you trust about their experience with software. For QuickBooks users, have a look at MyBizHomepage which offers a great tool allowing users to view important financial snapshots of their business through any Web browser. Click here to learn more.

Payroll Accounting

Payroll accounting and reporting is increasingly complex. If you will have employees, look up the “Payroll Accounting Service” providers in your area. Your accountant may have a recommendation. This complicated function can be outsourced at a reasonable cost.

Accountant As Advocate

Sooner or later, you will need financing in addition to your start-up sources. It is important to establish banking relations BEFORE future needs arise.

Your accountant can help you:

- Prepare cash flow control statements that will estimate what the cash needs of the business will be in months to come.

- Prepare a personal financial statement, including a balance sheet of your personal assets and liabilities along with a statement of income and expenses showing how much cash flow you generate each month. Banks will usually require a personal guarantee.

- Locate a banker. This can be helpful because the banker has had prior dealings with the accountant.

- Polish your business plan for your banker.

- Organize as much information as possible including financial statements in a neat and orderly fashion.

Methods of Accounting

Before you start, you will need to decide what form of accounting your business will use. There are two major types:

Cash Basis Method

This is what the name implies; you recognize income when you receive the cash and you recognize expense when you pay the bill. Most service businesses operate on the cash basis because it is much simpler to understand.

Accrual Method

Here you match revenue with expense regardless when the cash may or may not be collected. If you sell a product to a customer and he doesn’t pay you for 30 days, the sale is recorded in the books on the day that you made the sale. When the money comes in the “accounts receivable” is then turned into cash. The same with expenses: if you incur an expense on one month but don’t pay until the next month, the expense will be recognized in the month in which you incurred the expense. If you’re in manufacturing or deal with inventory, the Internal Revenue Service generally requires that you be on the accrual basis.

The cash method is the most simple in that the books are kept based on the actual flow of cash in and out of the business. Income is recorded when it is received, and expenses are reported when they are actually paid. The cash method is used by many sole proprietors and businesses with no inventory.

From a tax standpoint, it is sometimes advantageous for a new business to use the cash method of accounting. That way, recording income can be put off until the next tax year, while expenses are counted right away.

With the accrual method, income and expenses are recorded as they occur, regardless of whether or not cash has actually changed hands. An excellent example is a sale on credit.

The sale is entered into the books when the invoice is generated rather than when the cash is collected. Likewise, an expense occurs when materials are ordered or when a workday has been logged in by an employee, not when the check is actually written. The downside of this method is that you pay income taxes on revenue before you’ve actually received it.

Should you use the cash or accrual method? The accrual method is required if your annual sales exceed $5 million and your venture is structured as a corporation. In addition, businesses with inventory must also use this method. It also is highly recommended for any business that sells on credit, as it more accurately matches income and expenses during a given time period.

The cash method may be appropriate for a small, cash-based business or a small service company. You should consult your accountant when deciding on an accounting method.

Keeping Separate Business Records

Even in a small business you should, before you start, set up a business account even if you’re a sole proprietor. It will be important to keep your business records separate from your personal records.

This will make it easier for you and your accountant to pull records together for income taxes when the time comes. Your accountant can help you prepare and set up your company accounts, including establishing your checking accounts and or savings account for operating your business.

Tax Liability Issues

There will be a number of tax liability matters that you and your accountant will need to deal with:

Income Taxes

If you start as a sole proprietor you will be reporting your business activity on a schedule that is attached to your IRS form 1040, called Schedule C. Not only will the sole proprietor pay income tax on business income, but the sole proprietor will also pay social security tax on this income. This is reported as a separate item on the income tax return. The social security tax can be quite a surprise for the new small businessperson who does not expect to pay roughly 15% of net income for social security tax on top of the income tax. Operating as a partnership or LLC does not relieve a partner of the obligation of paying self-employment tax. Your accountant can help set up estimated tax payments that will lessen the burden of your final tax bills as well as avoid penalties for not paying taxes as you go along.

Payroll Taxes

If you have employees, your accountant can help you apply for necessary state and federal payroll numbers that you will need to file payroll tax returns. The federal number is called a “federal employer identification number” or FEIN, and these are obtained by form SS-4. Also, in every state there are local and state taxes that are required. For instance, in California you need to apply for a state identification number that will establish an account for you to pay the state withholding tax that you withhold from employees and the state disability insurance monies withheld. There is also a state unemployment tax that you pay. There may be other taxes that may be unique to your local situation.

Financial and Technical Assistance

Many times, there are sources of financing and technical assistance available to start-up businesses that are given by various organizations and agencies that wish to spur the development of small business. Your accountant may or may not be familiar with these sources, but this might be a question you would pose to a prospective accountant before you hire him or her. Financial and technical assistance may be available from:

- The Small Business Administration (SBA)

- SBA-guaranteed loans to businesses, handled through banks

- Local community banks, funded by the federal government

- Tax incentives available for hiring minority employees

- Trade organizations

- Service Corps of Retired Executives (SCORE), which is a nonprofit organization whose goal is to help small businesses become successful. SCORE offers workshops and seminars on various business topics and may give you the opportunity to talk to someone who has been down the same road before.

Internal Controls

“Internal controls” refers to what is needed in the handling of funds, where money in the form of cash, checks or credit cards, is exchanged for goods and services.

The goal is to make sure that the business receives all of its income without any of it being siphoned off by waste, fraud, dishonest employees or just through carelessness.

Even a business that is healthy in all other respects can be very vulnerable to failing from the inside through lack of internal controls. Your accountant can help set up appropriate controls for your particular business.

Damage control planning is an important part of internal controls. You will need to be prepared for adversities. If you are in a manufacturing or retail business you will need to set up inventory policies and controls because inventory, similar to cash, can disappear very rapidly through carelessness or employee dishonesty.

You need to have safeguards in place very early on in the process by setting up controls as to who can sign for goods and services and who controls the release of goods and services out the door after the processing has been completed.

You are probably getting the idea by now that in your selection process of retaining an accountant, it is a good idea to get one with experience in your industry.

Quarterly Returns

Quarterly returns are primarily payroll tax returns and sales tax returns. Start-up businesses need to file quarterly payroll tax returns and send the money that has been withheld from the employee’s check as well as the employer’s share of social security taxes to the federal government.

Likewise, state income taxes that are withheld and state unemployment tax that the employers pay to the state must be accounted for.

These are matters you need to get right from the beginning, so that these taxes are paid in the appropriate time frame and you’re not penalized for late payment or non-payment of your tax obligations.

It is a common occurrence for start-ups to be short of cash. And it is very tempting to hold off paying certain obligations to conserve cash.

Yet, you should not fall into that trap with your government obligations because governmental agencies have little patience with delinquent taxpayers.

Similarly, the sales tax money that you collect, in states that charge sales tax, needs to be forwarded to the state, either on a monthly or quarterly basis depending on the volume of your sales.

Quarterly reports will be required to show how much you have collected and that you have submitted this money to the state in a timely manner.

Bank Account Reconciliation

We suggested earlier that you set up separate business accounts to make it easier to track expenses and business income.

This bank account needs to be reconciled at least once a month when you receive your bank statement. You can save money by learning to do this yourself, and your accountant can teach you if you don’t know how.

Reconciliation refers to taking the balance in your checkbook and reconciling or mathematically comparing it to the bank balance. You must also take into account any difference in those two balances that are due to checks that you have written that have not yet cleared the bank.

If this is the case, your checkbook balance will be lower than the bank statement because the bank has not yet seen some of the checks you have written.

So it is important that these outstanding checks get subtracted from the bank balance and the resulting number be compared to the number in your checkbook. When the two match, we say the account has been reconciled.

Employee Benefits Policy

As you add employees to your business, you will need to decide:

- How many hours people will work.

- What holidays they are entitled to.

- What your vacation policy might be.

If you elect to cover employee medical expenses or provide medical insurance, you will need to give some thought to what type of policies you will provide.

This might be an HMO, PPO, or pick your own doctor policy.

What sick leave policy to offer. Will you pay employees when they are sick or will this time be considered unpaid time off?

Be sure to refer to the Fair Labor Standards Act when making this determination. There are different requirements for hourly vs. salaried employees.

There are a number of sources to give you some help in deciding these issues: Start with your accountant and lawyer.

Your own experience in your particular industry will help determine your policy. What has worked for similar companies in the past is very likely a good way to consider going with your own company so you are competitive with other firms in your industry.

Organizations such as SCORE can be helpful in determining policies and procedures.

Next Steps

Up to now, you have consulted with an accountant and have gone to school to learn basic accounting. The next step in getting to know how accounting and cash flow works is to do your own bookkeeping in your start-up mode.

This is invaluable because as you do the bookkeeping and understand the records that are involved, you are in a much better position to bring in employees and train them as the business grows. You can then devote your time to more of a manager level.

If you have a willing spouse or trusted friend, they can be invaluable in doing the bookkeeping. If you are doing your own bookkeeping, it is very important that you choose the right software. A good program that’s easy to use can help make your life a lot easier. The two best programs on the market are QuickBooks and Peachtree.

Making entries into a software program does not require a trained bookkeeper but it is important that you, the business owner, have a full understanding of double entry accounting.

There is one aspect of bookkeeping that you could consider delegating: payroll and payroll reporting, which can be handled by Payroll Service Providers at a low cost.

If you are in a partnership, it is especially important that you have knowledge of the accounting as well as what is happening in the other areas of the business. Remember that in a partnership, all the partners have authority to commit to the partnership. If a partner in charge of accounting doesn’t do a good job, it can affect all the partners.

Major Financial Statements and Software

Balance Sheet

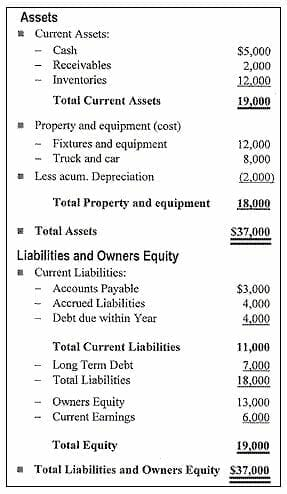

The balance sheet is a “point in time” statement. Think of it as a snapshot. It is a listing of all of your assets as well as your liabilities, and the difference between these two numbers is your equity in your business. You will see in the example that the balance sheet is divided into two major sections. The first section is “Assets.” The second section is “Liabilities and Owner’s Equity.”

The general order of a balance sheet is to go from the most liquid to the least liquid. In other words, under “assets,” you see the heading “current assets” and the first item is cash, because cash is the most liquid of your assets. After cash are receivables, representing money owed you from customers. When you receive the money, the receivable turns into cash. Next in assets are “inventories.” Since inventory is not as liquid as either cash or receivables, this falls below them on your balance sheet. Following current assets are property and equipment that are typically carried at cost.

You will also notice “depreciation” on a balance sheet prepared by an accountant. Depreciation is a non-cash expense and is nothing more or less than an attempt to record that these assets go down in value over time. IRS Publication 946 “How to Depreciate Property,” contains information that will give you a better understanding of depreciation.

One reason this particular financial statement is called a “balance sheet” is that assets always equal your liabilities and owner’s equity. This is called double-entry bookkeeping, and is the type done in nearly every business. The reason double-entry bookkeeping is the accounting gold standard is that it serves as a check to make sure a transaction has been properly recorded. For example, let’s say the first thing you buy is a desk. You have an asset of office equipment. If you paid cash, you don’t owe any liabilities so your interest in that desk is called your equity (on the other side of the ledger).

Similarly, other transactions will give rise to an increase in assets and/or an increase in liabilities or equity. For example, looking at our balance sheet example under current liabilities (again, from most liquid to least liquid) your account payables are the first item listed. After that there are items called “accrued liabilities,” which usually refers to payroll taxes and sales taxes that may not be due for another month or two.

Also under current liabilities is debt that is due within a year. So, the current 12 months of payments for equipment would be shown as a current liability. Following that we have long-term debt, which are items that are due after the current year.

Following total liabilities is the section called “owner’s equity” which is the owner’s interest in the business. If we take all the assets of the business, $37,000, and subtract the total liabilities, $18,000, there is a difference of $19,000. Of this $19,000 amount, $13,000 is from past income and $6,000 is from income earned during the current accounting period, thereby balancing out $37,000 for both assets and liabilities and owner’s equity. In order to create your own starting balance sheet, we have provided a Balance Sheet Template which can be updated and expanded over time.

When bankers look at a financial statement, they are interested in various financial ratios. Ratios help indicate the financial strength of a business and how the business can handle payback of loans. For example, current ratio is current assets divided by current liabilities. If your current assets are less than your current liabilities, a red flag will go up because it would indicate a risk of insolvency during the present year. Various industries will have different levels of ratios. You can track your ratios with others in your industry to see how your business compares. Your banker will probably be most interested in your owner’s equity.

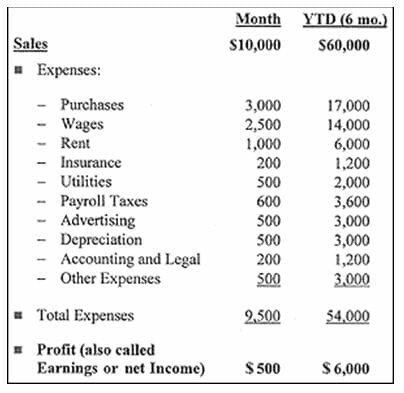

Income Statement

The income statement (also called the “Profit and Loss” statement), unlike the balance sheet, covers a period of time, usually monthly or quarterly. Usually year-to-date figures are also presented to show how the business is doing during the current accounting year. In the example shown here, the financial statement covers a six-month period and shows the activity for the current month as well as the year-to-date total of the prior five months plus the current month, for a total of six months.

The income statement and the balance sheet tie together. Look back on the balance sheet and you’ll see current earnings of $6,000. The income statement shows this same $6,000, which was the profit for the last six months. An Income Statement Template is provided and can be your starting point in organizing and refining your own income statement.

Your income statement will disclose valuable information. You will see a section for sales as well as a breakdown of all your expenses, leading down to the net profit for the period. The more current your financial statement, the greater will be its value. If you see a bad trend developing, you can take action at once.

Computer programs can produce financial statements with a keystroke, which is why you need to acquire the computer skills and software that are appropriate for your particular business.

Cash Flow Control

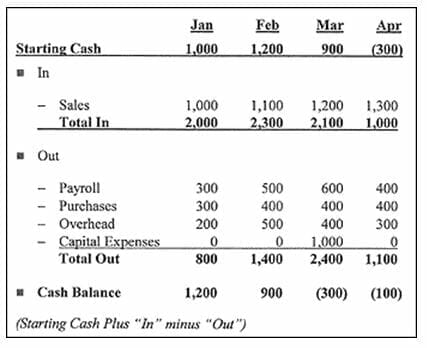

Cash fuel drives you in business just as jet fuel keeps a plane aloft. A pilot is very careful to accurately predict the fuel requirements. You should place the same importance on cash flow control because if, at any point in the future, you run out of fuel, like the pilot, you’ve got a BIG problem.

Cash flow control is a simple method of projecting your future needs for cash. It is an income statement covering future periods of time that has been changed to show only cash: cash coming in and cash going out and what your balance of cash is at the end of designated periods of time. This is a great tool because you can predict your future needs for cash before the needs arise.

In cash flow control, for each of a number of intervals of time, you make conservative estimates for your future sources of cash (IN) and future expenditures (OUT). Use low, conservative figures for IN items and use high estimates for OUT items. For the initial period, say a month, you start with the cash you now have. To this you add IN items and subtract the OUT items, which results in the cash at end of the month. The cash at the end of month becomes the starting cash for the next month.

The attached cash flow control spreadsheet shows that ending cash for this first period becomes the starting cash for the second period. The ending cash for the second period becomes the starting cash for the third period, and so on. Your projection should be made for an upcoming 12-month period. To prepare your own 12-month cash flow the Cash Flow Template can be a very useful tool. The projection will be a useful tool for you to arrange financing before it is required by showing your banker that you are sophisticated enough to provide for future cash in order to preserve liquidity.

You can use this simple cash flow format to make up your own cash flow projection for the business you have in mind. It is so simple, yet can be so valuable!

Accounting and Cash Flow Punch List

- Prepare frequent financial statements, at least monthly or even weekly.

- Keep track of key income statement percentages. If you’re in manufacturing, your cost of goods sold percentage should be relatively the same as competitors in your industry.

- Compare your income statement with prior periods.

- To start with, you won’t need certified financial statements. Accountants have three levels of statements: certified, reviewed and compiled. For most startups, the compiled type will work; that is, your accountant prepares the financial statement with a letter stating that the numbers are based on the information you have provided.

- From the beginning, maintain good internal controls. Learn from the practices used in your industry to prevent dishonesty and shrinkage. Shrinkage includes shoplifting and other types of stealing, which results in the “shrinkage” of your inventory.

- Do not delegate the authority to sign checks or purchase orders.

- Don’t use money that you have withheld for payroll taxes or sales taxes for other purposes. You will be a trustee of funds belonging to the Internal Revenue Service, Social Security Administration and your state’s sales taxing authority. A “payroll service provider” can be used to manage these responsibilities.

- Keep in mind that liquidity is not the same as making money. You can be making a profit and still go broke by running out of cash. Learn and practice cash flow control.

- Look ahead and write out your list of projected financial requirements including premises, equipment, staff and working capital.

- Arrange for financing well before the need arises.